Planned giving: A win-win scenario

By David H. Glusman, CPA and member of the JDRF Eastern PA Board of Directors

JDRF has various ways for our supporters to provide the funds used for our pathways to a cure for type 1 diabetes (T1D). One way not often discussed is “planned giving,” so I will try to answer the question “What is ‘planned giving’ and how does it benefit me and JDRF?”

What is planned giving?

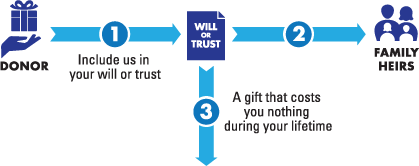

Planned giving is any gift that is designed to be made with a specific and usually deferred benefit.

The main vehicles are:

- Putting JDRF in your will. This is simple and does not take place until after your death, or, if so planned, after the death of a wife and husband. It can be accomplished when you’re revising or planning your will, or, often simply, with a codicil to your existing will. The JDRF donor can get assistance from their estate planning counsel or JDRF can provide suggested language. This can be a specific amount or a percentage of the estate.

- Purchasing a life insurance policy with JDRF as the beneficiary. In this instance, like the above, JDRF will benefit at the end of the donor’s lifetime. The donor receives a tax deduction for the insurance premiums as long as JDRF is the sole beneficiary of the policy and the gift is irrevocable. JDRF can also be named as the beneficiary of an existing policy.

- Establishing a JDRF Charitable Gift Annuity. The IRS code allows for a tax deduction at the time of the gift, subject to the usual limitations, and an exclusion from income for a portion of the annuity payments received during the donor’s lifetime. The amount of the annuity, paid quarterly, depends on current Charitable Gift Annuity rates based on the age(s) of the donor(s). Donors can fund the annuity with cash or appreciated securities, providing additional tax benefits to the donor.

- Creating a Charitable Remainder Trust. This is similar to a Charitable Gift Annuity but terminating with the balance going to JDRF after a specific timeframe—say 10 years—or the death of the donor(s), whichever comes first.

- Utilizing IRA options. You may also, under current IRS regulations, directly contribute a portion of your IRA instead of taking that portion of your Required Minimum Distribution (RMD). In working with your tax planning professional, this may provide additional tax benefits, as it eliminates the need to take and report the RMD on your tax return. You can also name JDRF as a beneficiary of your IRA or other retirement account, enabling JDRF to receive a distribution at the end of your lifetime.

Feel free to contact Alan Berkowitz, JDRF National Director of Planned Giving, at plannedgiving@jdrf.org or 1-877-533-4483 or visit jdrf.plannedgiving.org for additional details on these and other giving options. With thoughtful planning, your gift can create win-win solutions for you and JDRF.

Did you know that JDRF just launched a Global Legacy Challenge? Include JDRF in your estate plans and generous sponsors will contribute $1,000 to support current type 1 diabetes research!