Medicare and Type 1 Diabetes

Medicare is a federally run health insurance program for people age 65 and older and people with disabilities. The best places to find information on the Medicare program are www.medicare.gov, the Medicare and You Handbook and the Medicare Plan Finder. This guide will provide some general detail about options for Medicare coverage and identify specific issues that are very important for people with type 1 diabetes (T1D) to understand as you make decisions about your Medicare coverage.

In this section we’ll discuss

- The basics of the Medicare benefit

- Options for coverage under Medicare

- How Medicare beneficiaries with T1D can best manage insulin costs

- Coverage of continuous glucose monitors (CGMs) under Medicare

- Coverage of insulin pumps and artificial pancreas systems under Medicare

1. The basics of the Medicare benefit

Medicare consists of four basic parts, including:

- Part A, which covers primarily inpatient hospital and skilled nursing facility services.

- Part B, which covers primarily physician and outpatient hospital services, as well as durable medical equipment such as insulin pumps, test strips and some CGMs.

- Part C, also known as Medicare Advantage (MA) plans, are offered by private insurance companies and cover the same benefits as Medicare Part A and B, plus many offer drug coverage, similar to Part D

- Part D, which covers prescription drugs that you typically obtain at a pharmacy, and may also cover disposable insulin “patch pumps”.

As a person with T1D, Parts B and D will be the most relevant to your day-to-day diabetes management. We’ll discuss why below.

2. Options for coverage under Medicare

When you are eligible to enroll in Medicare, you have two basic options.

The first option is to enroll in Original Medicare Parts A and B, which is managed by the federal government. You’ll need to enroll in a Part D drug plan separately from your enrollment in Original Medicare since the Part D portion of the benefit is offered only through commercial insurers.

Depending on your income, your costs for Part D coverage may be significantly reduced. In order to receive this reduction, you have to apply for the “extra help.” There’s no downside for applying and you can re-apply every year since your income and the qualifying criteria change each year.

If you enroll in Original Medicare, you can also purchase a separate Medicare supplement or “Medigap” policy that can cover your deductibles and cost-sharing under Parts A and B (but not Part D) in return for a fixed monthly premium. As explained below, the ability to purchase a Medigap policy could be critical for many people with T1D and the timing of when you purchase Medigap coverage is very important.

You can purchase a Medigap policy any time after you enroll in Medicare. However, with a few exceptions, if you purchase it after the six-month period that begins when you initially enroll in Part B, Medigap insurers are permitted to deny you coverage or charge you a higher premium based on any pre-existing health condition you may have (such as T1D). Some states, including Massachusetts, Minnesota and Wisconsin, have different rules for Medigap plans so be sure to find plan information specific to your state. There are also different rules for people under age 65 who are eligible for Medicare due to disability (such as blindness) or End-Stage Renal Disease (ESRD). For more information on choosing a Medigap policy, click here.

The second option is to enroll in a Medicare Advantage (MA) plan, which is coverage that is at least equivalent to Original Medicare, offered through a commercial insurer. Most MA plans also cover the Part D portion of the Medicare benefit, though some don’t. If you select an MA plan that does not cover Part D prescription drugs, you’ll need to sign up for a Part D plan separately. Medigap plans do not work with MA or Part D plans.

As you make decisions about which route to take, you should carefully review information in the Medicare & You Handbook, notably deadlines for enrolling and particulars around coordinating other types of coverage such as those available to retirees from a former employer or from the military or U.S. Department of Veterans Affairs. You should also pay special attention to rules around income changes that may affect how much you will pay for Medicare part B.

The authoritative place for evaluating available options for Medicare coverage is the Medicare Plan Finder.

3. How Medicare beneficiaries with T1D can best manage diabetes health care costs

It is impossible to provide a single answer to the question “What is the best course for people with T1D who are covered under Medicare?” The response depends on a number of factors, including whether you have complications associated with T1D or other health conditions that need treatment, your financial situation, whether you prefer to have higher fixed monthly premiums in return for lower cost sharing, and how much you care about having broad access to physicians and hospitals.

Some key questions to ask yourself are:

- Am I willing to change insulin delivery method for the sake of cost savings?

- What programs could I be eligible for that help with Medicare costs?

- Are my diabetes devices covered by Medicare and if so, are they covered under Part B or Part D? What are the costs associated with coverage under the different Parts?

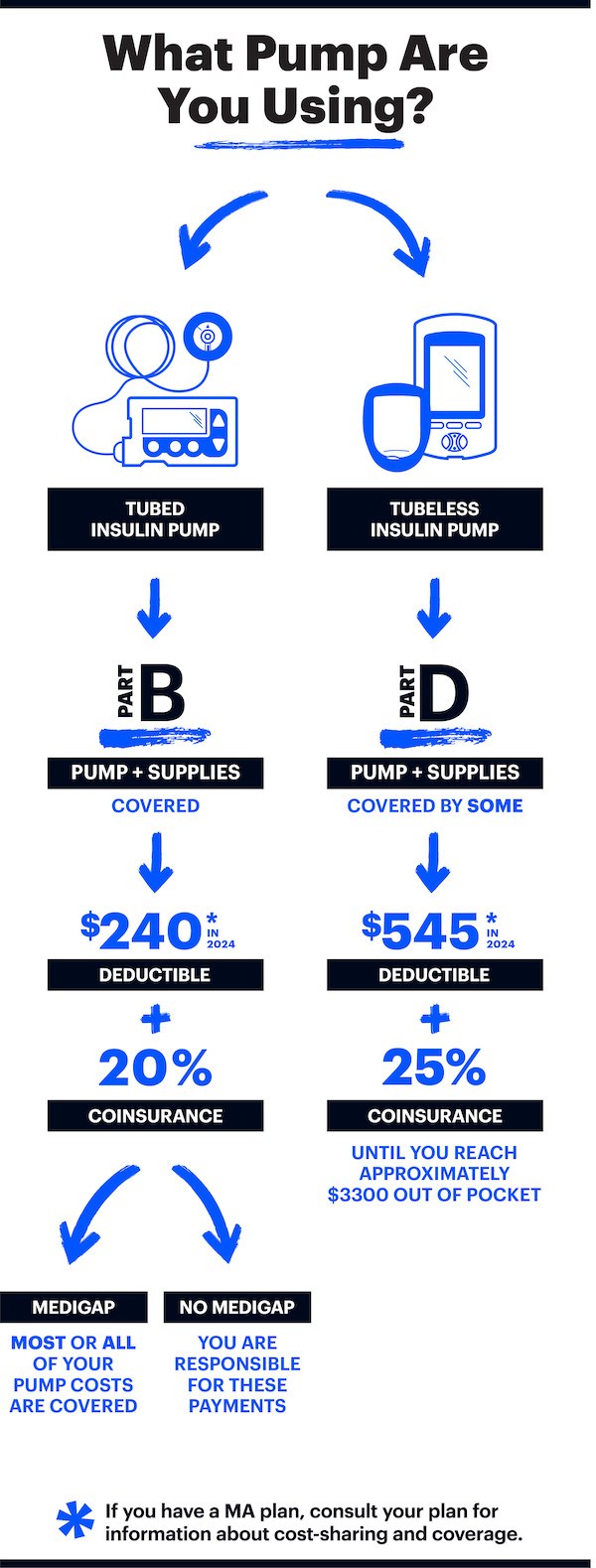

Keep in mind that insulin is covered by Part B or Part D, depending on how it is administered. If you are using a tubed pump, the insulin is covered by Part B. This is because drugs delivered by a long lasting device are considered to be part of the “durable medical equipment” benefit. If you are use a disposable patch pump or are using multiple daily injections, insulin will be covered by Part D plans.

Starting in January 2023, Part D covered insulins will cost no more than $35 per month per insulin at the pharmacy counter or mail-order checkout. For tubed pump users who get their insulin through Part B, the $35 out-of-pocket cap will go into effect on July 1, 2023.

Medicare Advantage (MA) and Part D plans can still limit coverage to certain brands of insulin, however they must cover at least one of all types of insulin (long-acting, rapid-acting, etc) and in the different delivery forms (vials, pens, etc).

While the out-of-pocket price of insulin has been capped at $35 for both Part B and Part D, most Part D or MA plans will NOT reflect this cap when shopping for a 202 plan. This means that cost estimations from the Medicare Plan Finder will not be accurate for insulin.

When January 2023 rolls around, it’s very possible that many MA and Part D plans will not have fully implemented the $35 out of pocket cap at the checkout. If this is the case, the plan must refund any overpayment that you make at checkout within 30 days.

Deductibles won’t apply for covered insulins for both Part D starting January 1 and Part B starting July 1, 2023. This means that you will only pay the copay for your insulin, and the amount paid will count toward your deductible. Keep in mind that your CGM, test strips, insulin pump or supplies will still be subject to the deductible, which is $226 for Part B and a maximum of $505 for Part D plans.

Insulin for use in a pump must be obtained from a Medicare durable medical equipment (DME) supplier, not a retail pharmacy. However, many national pharmacy chains are set up to bill Medicare as a DME supplier. Speak with your pharmacist to verify if they can do this. Typically the DME supplier is the same entity that provides your pump and associated supplies, however, not all DME suppliers are set up to provide insulin.

Test Strips

Test strips are covered by Medicare Part B. People who use insulin are covered for 100 test strips per month however, if you and your doctor can show that you need to test more often, Medicare may cover additional test strips. Medicare may require you to mail-order your test strips from contracted supplier. Your doctor will need to write you a prescription for test strips to ensure they are covered.

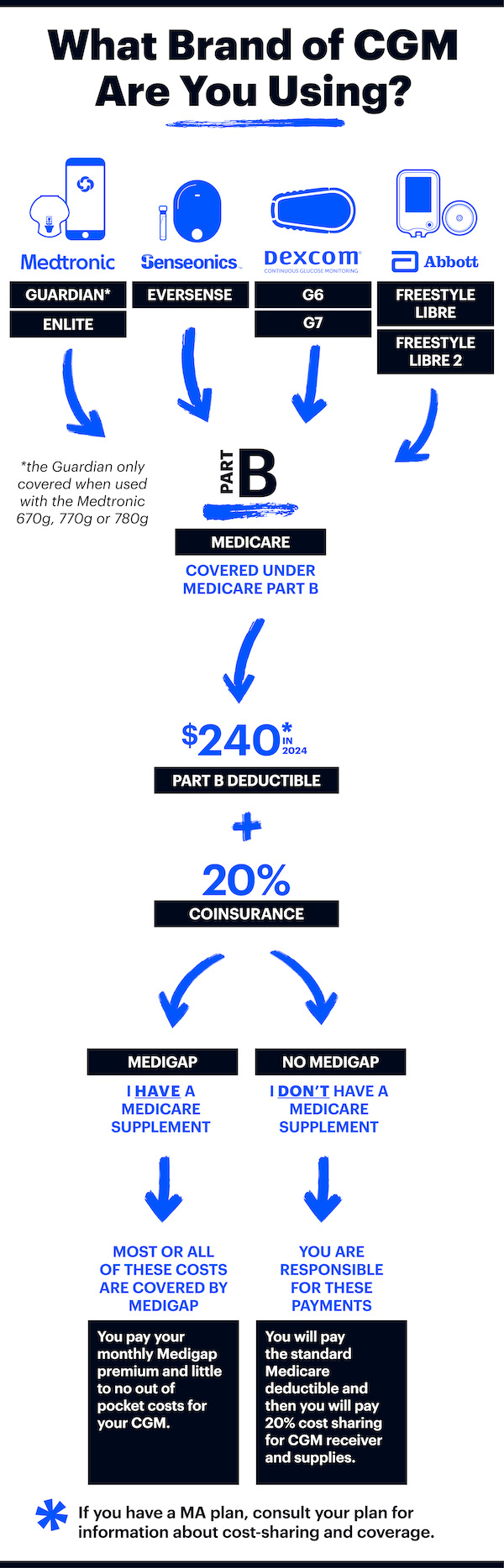

4. Coverage of CGMs under Medicare

Medicare will only cover a CGM if the FDA has approved the CGM for use in diabetes treatment decisions or if it is FDA approved and pairs with an insulin pump. Standalone CGMs have been granted coverage under Medicare: the Dexcom G6, the Abbott FreeStyle Libre and Libre 2, and the Eversense Implantable CGM. The Medtronic Guardian Sensor 3 CGM, when used as part of the 670G and 770G artificial pancreas systems, is also covered by Medicare.

Medicare allows the use of a smart device in conjunction with a CGM system receiver or insulin pump, so you can use it to review data yourself or share it with others.

5. Coverage of insulin pumps and artificial pancreas systems under Medicare

Medicare covers tubed insulin pumps under its “durable medical equipment” (DME) benefit. There are specific medical eligibility criteria that must be met in order for such coverage to be given.

Part D plans may choose to cover patch pumps. There is one patch pump on the market now (the Omnipod) and there are several in development. Medicare beneficiaries wanting coverage for a patch pump should check with any Part D plan they are considering joining, before doing so, in order to verify that the plan covers patch pumps.

Medicare covers FDA-approved artificial pancreas systems, including the Tandem Control-IQ, the Medtronic 670G & 770G and the related supplies. Both systems consist of a tubed insulin pump and a CGM covered by Medicare Part B. Medicare also covers the Omnipod 5, with the pods covered by some part D plans and with the Dexcom G6 covered by Part B.

Key Takeaways

Medicare currently covers most CGMs: the Dexcom G6, the Abbott FreeStyle Libre & Libre 2, and the Eversense Implantable CGM. It also covers the Medtronic Guardian Sensor 3 when used with the 670G & 770G insulin pump. You may use a smart device in conjunction with your CGM receiver or insulin pump.

Starting in January 2023, Part D covered insulins will cost no more than $35 per month per insulin at the pharmacy counter or mail-order checkout. For tubed pump users who get their insulin through Part B, the $35 out-of-pocket cap will go into effect on July 1, 2023.

- Some, but not all, Medicare Part D plans cap insulin copays at $35 per month. You must choose one of the plans that offers this benefit to take advantage of this program.

- Medicare Part D plans may cover the Omnipod. Insulin used in a disposable patch pump such as the Omnipod will be covered under Part D.

- Medicare covers all currently available artificial pancreas systems, Tandem Control-IQ, Medtronic 670G & 770G and Omnipod 5.

- It is critical to purchase a Medigap policy during a time when you won’t be denied or charged higher prices based on your health. Learn when those times are as some are once-in-a-lifetime occurrences.

- If you use a tubed insulin pump and have a Medigap policy, there will likely be no charge for the insulin used in that pump other than the monthly premiums you pay for Part B and the Medigap policy.

- Medigap will not cover cost-sharing under Part D.

JDRF maintains a forum where insurance issues can be discussed.

If you have questions for the community, you can post them here!

Is this resource helpful? Did we miss something? Let us know!