Our Financial Efficiency and Responsibility

At JDRF, we are part of the very community we support. This makes us passionately driven to cure T1D and improve the lives of everyone impacted by this disease. This also makes us personal stewards of every donation made to JDRF and drives us to make each donation bigger by attracting expertise and additional funding from other organizations and partners.

We steward every donation and maximize its impact.

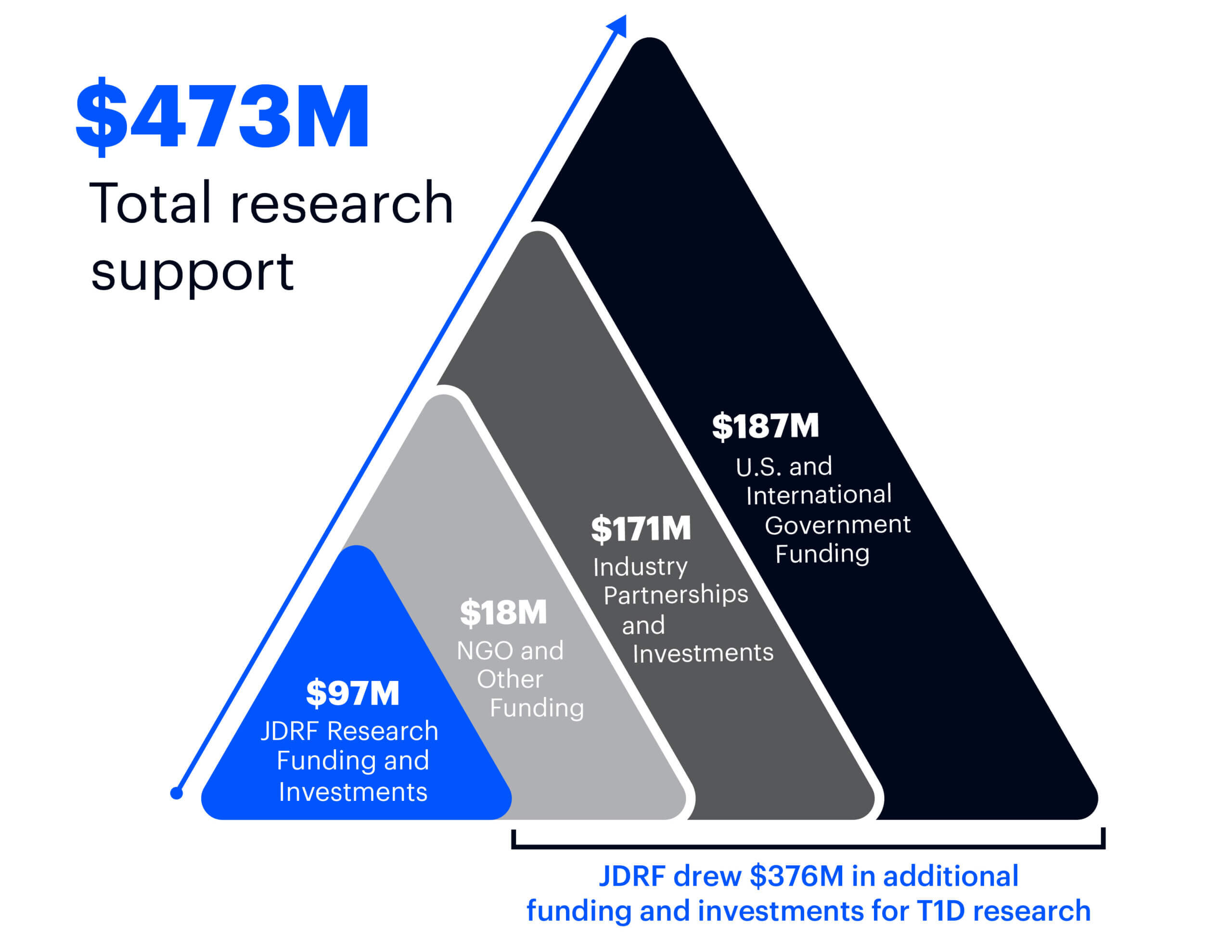

In fiscal year 2022, we drew $376M in additional funding and investments for T1D therapy research and development from partners in the private and public sectors. We refer to these funds as “leverage.”

Learn more about JDRF’s Impact through our Research and Advocacy efforts.

This leverage is a key part of JDRF’s strategy to accelerate cures and life-improving therapies. It has empowered us to grow global support of, and investment in, T1D research.

JDRF International uses direct appeals to drive a call to action for optimal healthcare for people living with T1D, as well as public policy advocacy. This education and information delivery is inherent in our mission statement—leading the fight against T1D by funding research, advocating for policies that accelerate access to new therapies, and providing a support network for millions of people around the world impacted by T1D. As a result, in accordance with the Financial Accounting Standards Board (FASB) guideline and Internal Revenue Service (IRS) guidelines, we allocate a portion of our direct appeal costs to program services.

Download our document “Driving T1D Cures Forward, Faster” [PDF] to learn more about how JDRF globally maximized each donation in FY22 by attracting additional funding for cures research and advances to improve lives.

Financial documents

Our tax identification number is 23-1907729.

JDRF is a charitable organization with tax-exempt status granted under Section 501(c)(3) of the U.S. Internal Revenue Code. All chapters and branches are covered under this umbrella. Donations to JDRF are tax-deductible to the full extent allowed by law. Please view our page about state charitable solicitation disclosures for additional information.

Annual Reports

- Annual Report 2022 | Donor Honor Roll

- Annual Report 2021 | Donor Honor Roll

- Annual Report 2020 | Donor Honor Roll

- Annual Report 2019 | Donor Honor Roll

Audited Financial Statements

- Audited Financial Statements 2022

- Audited Financial Statements 2021

- Audited Financial Statements 2020

- Audited Financial Statements 2019

IRS Form 990

- IRS Form 990 FY22 (form Year 2021)

- IRS Form 990 FY21 (form Year 2020)

- IRS Form 990 FY20 (form Year 2019)

- IRS Form 990 FY19 (form Year 2018)

Additional tax information

- 501(c)(3) Exemption Determination Letter from IRS

- JDRF International Letter of Good Standing

- JDRF Form W-9

Nevada Drug Transparency Compliance Report

JDRF’s funding comes from many sources, the vast majority from the millions of people affected by T1D. Any contribution from pharmaceutical companies and device manufacturers is small compared to what we raise directly from the T1D community.